Selling rental property tax calculator

For example investors should gather as much information as possible about the property like the purchase price and property value. Taxes rental property investors need to pay.

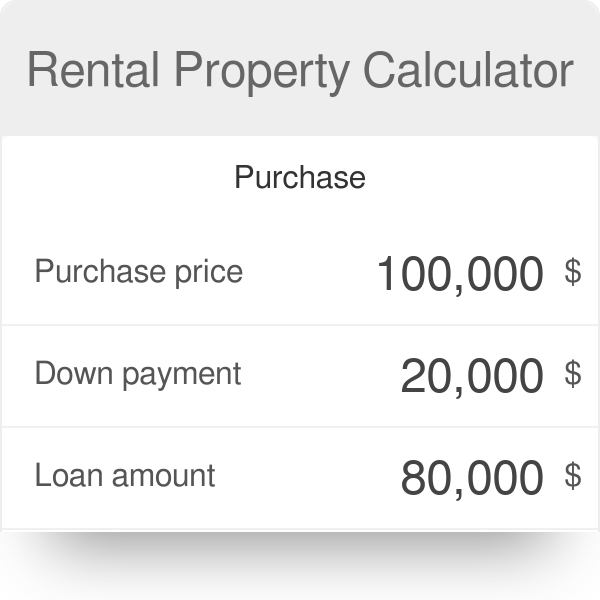

Rental Property Calculator Most Accurate Forecast

2454 in rental income tax.

. So if the house declined in value before converting it into a rental property you might have a low basis and not have a tax loss. Calculating the tax payable upon selling inherited property is complicated and depends on a number of factors including your income and a tax-free allowance known as the Annual Exempt Amount. Investing in rental property can prove to be a smart financial move.

As a result your taxable rental income will be. Just the act of inheriting a home doesnt make you responsible for additional taxes in most states except for the yearly property taxes youll pay as the new owner. Karl and Louisa bought a residential rental property in November 2016 for a purchase price of 750000.

Therefore no matter how much rent is paid only 10 of the rent can be claimed for the homestead property tax credit. This means that your rental propertys rate of return is 69. When you sell a rental property you need to pay tax on the profit or gain that you realize.

The Rent vs Sell calculator will automatically calculate your answer. The good news is that HMRC also provide a handy CGT calculator to help you calculate capital gains on inherited property for your personal situation. Bought the property and you had a firm intention to sell it.

The next 4730 will be taxed at 40. A rental property can be a profitable real estate investment if you understand the risks involved as well as the potential return on investment ROI. Your rental earnings are 18000.

Now to calculate the rental propertys ROI follow the previous cap rate formula and divide the annual return 7600 by the total investment you initially made 110000. This included depreciating assets worth 12000. Have a history of buying and selling.

The IRS taxes the profit you made selling your rental property 2 different ways. 1892 in rental income tax. Karl and Louisa bought a residential rental property in November 2016 for a purchase price of 750000.

Interactive Property Tax Calculators. Input values in the calculator on the left to get a quick read on the financial viability of renting or selling your house. You can claim 1000 as a tax-free property allowance.

Rate of Return on a Rental Property Calculation. To figure out the depreciation on your rental property. Allocate that cost to the different types of property included in your rental such as land buildings so on.

If you sold a buy-to-let property between 6 April 2020 and October 27 2021 and are required to pay CGT you have 30 days from the completion date to notify HMRC and make a payment. Calculate depreciation for each property type based on the methods rates and useful lives specified by the IRS. They incur costs of purchase including stamp duty and legal fees of 30000.

The tax basis of the rental property is the lesser of the cost or the value when it is placed in service plus any improvements less any depreciation taken. Simply divide your rental income by the property value and then multiply it by 100 to get your rental yield expressed as a percentage. Although you dont normally pay tax on the sale of your main residence the rules around rental property sales are different.

First youll need to get the home rental-ready. Rental property investment refers to the investment that involves real estate and its purchase followed by the holding leasing and selling of it. Rental income tax breakdown.

The Basic Tax Calculator BTC is designed to help you calculate the tax. The capital gains tax rate is 15 if youre married filing jointly with. Many expenses can be deducted in the year you spend the money but depreciation is different.

When you rent property to others you must report the rent as income on your taxes. A great rental property calculator takes the guesswork out of forecasting your cash flow and makes it much easier to grow a profitable portfolio. 1300 x 12 15600.

Cash on Cash Return Calculation. A good capital gains calculator like ours takes both federal and state taxation into account. Selling or Disposing Property.

A capital gain or loss is the difference between what you paid for an asset and what you sold it for less any fees incurred during the purchaseSo if you sell a property for more than you paid for it thats a capital gain. For starters a rental property can provide a steady source of income while you build equity in the property. They incur costs of purchase including stamp duty and legal fees of 30000.

Selling rental properties can earn investors immense profits but may result in significant capital gains tax burdens. In this article Im going to give you one of the most important tools in any real estate investors toolbox. Capital gains on the sale of a co-owned rental property.

Determine your cost or other tax basis for the property. Depending on the type of rental property investors need a certain level of. Check Rental Transactions from other Government Agencies.

You may also have to pay tax on any profit when you sell the property. Turn it into a rental. Appeals Refunds Reliefs and Remissions.

This included depreciating assets worth 12000. If youre buying a rental property youll have to pay tax on the rental income you earn. Capital gains on the sale of a co-owned rental property.

Capital gains tax CGT for those who are new to this is the levy you pay on the capital gain made from the sale of that asset. Capital Gains Taxes on Property. Formula for calculating rental yield.

A rental property calculator works by relying on certain variables to determine the potential performance of the investment property. Annual rental income value of the property x 100 rental yield. Simply adjust the sliders on the calculator below to customize the financial details.

What is capital gains tax. Tax rate on rental profit. Service Fee Housing is a program where there is an agreement between a municipality and a rental property owner to pay a service fee instead of property taxes.

Generally any profit you make on the sale of a rental property is taxable when you. The Years to Hold whichever number of years you choose is considered the year that the property would. But you can deduct or subtract your rental expensesthe money you spent in your role as the person renting out the propertyfrom that rental income reducing your tax obligation.

New Hampshire doesnt tax income but does tax dividends and interest. Then factor in costs like 247 maintenance support property. How To Use A Rental Property Calculator.

A financial model for rental property that you can stand behind. Your monthly rental income is. Tax Compliance Go to next level.

Your annual rental income is. Tax Write-Offs. While investing in single-family rental property may often provide strong stable cash flow owning rental real estate can require a lot of time.

The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high taxes on capital gains too. Fortunately there are several ways to minimize and even avoid paying tax when you sell a rental property. The first 12270 will be taxed at 20.

Our rental property calculator looks at the upfront investment costs expenses and earnings to calculate the ROI.

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Home Sale Exclusion H R Block

How To Calculate California Sales Tax 11 Steps With Pictures

Calculating Returns For A Rental Property Xelplus Leila Gharani

Rental Property Calculator How To Calculate Roi

How To Calculate Rental Income The Right Way Smartmove

Calculating Returns For A Rental Property Xelplus Leila Gharani

Calculating Returns For A Rental Property Xelplus Leila Gharani

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Passive Income Tax Rate What Investors Should Know 2022

Rental Property Is Now The Right Time To Sell

Pin On Airbnb

Rental Property Calculator Most Accurate Forecast

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

How To Calculate Fl Sales Tax On Rent

Converting A Residence To Rental Property